Following the weight of the election result on Thursday, December 12, Savills farmland forecast is delivered with greater confidence, although this is part of the bigger story that still needs to be resolved.

A strong Conservative majority offers continuity in the farm business environment, even if a great deal of regulatory change faces the sector over the coming five years.

However, Savills analysis shows many standard market drivers are having less impact in the current market, as influences to buy, sell or otherwise trend more towards local and personal circumstance.

Gradual policy evolution

Emily Norton, of Savills rural research, commented:

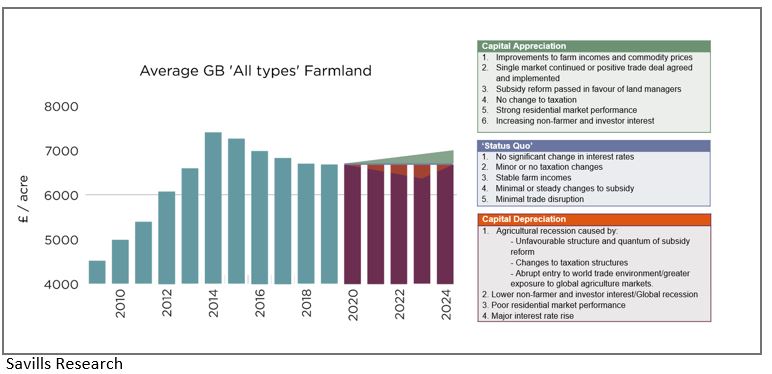

“We have identified the major influences which, in combination, could drive three market scenarios over the next five years; an appreciating market, the status quo and a depreciating market.

The election of a Conservative Government signals a move to freer trade and higher environmental protectionism, but with budgets protected for the duration of the next parliament, landowners and occupiers may take additional comfort that policy evolution will be gradual rather than sudden.

Savills rural research predicts that the rural economy is more likely to perform positively in the five years ahead, at least once the first Brexit hurdle is passed and expects the capital appreciation scenario to prevail, with local factors remaining the predominant influence on land values.

Rural Scotland

One question mark remains over the strong vote for the Scottish National Party (SNP) in Scotland.

Whilst Scottish rural assets remain attractive globally, an increased domestic independence agenda should not adversely impact on the performance of the Scottish rural economy. However, a prolonged period of uncertainty and conflict is likely to continue to weigh on sentiment.

Alex Lawson, director of farms and estates, commented:

With uncertainty expected to ease over the short to medium term, landowners will be reassessing growth options. The likely restructuring of agricultural payments is expected to put pressure on returns from farming and force the hand of some sellers who are unable to invest or restructure. This is expected to bring a variety of land types to market.

“The prevailing low cost of funds and a volatile global trade market may also attract a greater number of buyers providing other investment objectives are met.”

The current volatility of the pound also boosts this sentiment. In all situations, upside potential is predicted to be greater than any downturn, largely due to environmentally oriented demand for land use underpinning the lower end of the market.