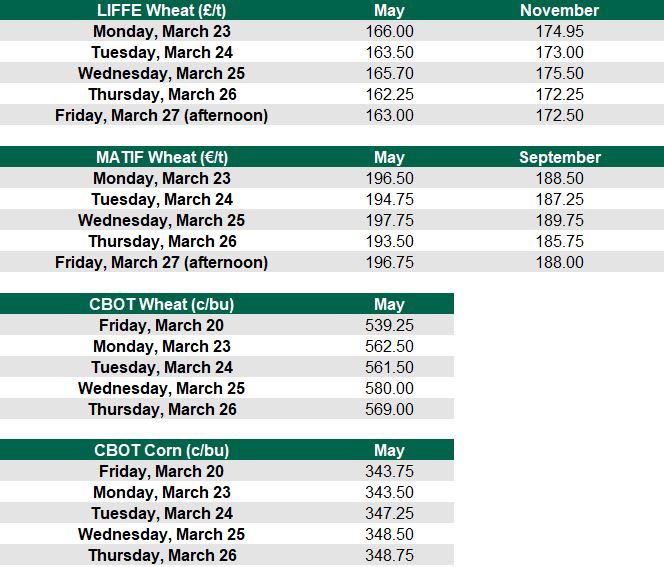

Wheat markets showed substantial increases this week, but there was volatility in the market. MATIF wheat for May moved from €191.25/t on Friday, March 20, to €197.75/t on Wednesday evening, but had moved back to €193.50/t by Thursday evening.

The MATIF price for September moved from €185.25/t to €189.75/t, but dropped back to €185.75/t in the same period.

Chicago Board of Trade (CBOT) wheat also jumped from 539.25c/bu at the end of last week to 580c/bu on Wednesday evening. CBOT corn did not see the same move. It increased by just under 5c/bu in that period.

The Covid-19 pandemic is the big influence in the market and while wheat is in plentiful supply at present bulk buying in supermarkets and logistics fears are affecting price.

The stimulus package announced in the US this week saw the value of the dollar weaken and so this gave support to US commodities. This may also have contributed to a dip in LIFFE and MATIF prices on Tuesday evening, March 24, as the sterling and the euro were stronger than the US dollar.

LIFFE wheat above 20 and 50-day rolling averages

However, data from the Agriculture and Horticulture Development Board (AHDB) in the UK on Wednesday, March 25, shows that May 2020 and November 2020 wheat futures are well above their 20 and 50-day rolling averages.

Grain markets

This week, Glanbia offered farmers a green price of €157/t for wheat and €140/t for barley delivered in the 2020 harvest. These prices are base prices and do not include any potential payments to co-op members.

Spot prices for barley on the continent improved this week. Last Friday, March 20, feed barley on the continent (delivered Rouen) was priced at €162/t. This Friday afternoon, March 27, that price was at €166/t. The spot price for malting barley on the Free-On-Board (FOB) Creil was at €158/t on the same day.