Paris rapeseed futures reached their highest price since March 2017 this week. On Tuesday (January 7), the price closed at €416.50/t – the highest since March 2017.

The price then continued to climb, hitting €420.50/t on Friday morning, January 10. The progress with the US/China trade deal has helped to move the price up in recent weeks as Chicago Board of Trade (CBOT) soybean prices see an improvement.

New crop wheat gaining in the UK

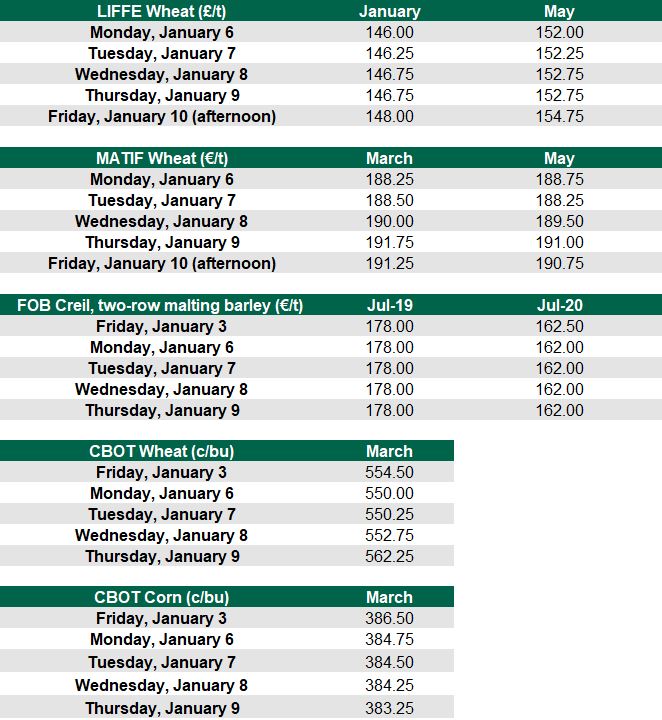

Nearby LIFFE wheat hasn’t moved any big amounts since the end of last week.

However, November wheat in the UK is bridging a gap. On Friday morning, January 10, new crop wheat (November) was trading at £162.45/t. That was £8.45/t ahead of May which was trading at £154.00/t.

The chart below from the Agriculture and Horticulture Development Board (AHDB) shows the spread between the prices.

The new crop premium can be at least partly attributed to a fear of a smaller UK crop following a wet winter which saw less winter crops planted.

The new crop premium can be at least partly attributed to a fear of a smaller UK crop following a wet winter which saw less winter crops planted.

MATIF wheat is acting differently, while the price climbed this week to €191.75/t for March and €191.00/t for May, new crop prices were behind. On Friday morning, January 10, MATIF wheat for September was trading at €187.50/t.

Further a field, the first Brazilian maize crop of the year is approximately a month away from harvest in February and soil moisture levels have been at a five-year low since September.

Planted area had increased in Brazil and projections were for a rise in production. As supplies may now tighten this may help to increase prices in the region and in turn have an impact on other markets.

Grain markets

At home Glanbia offered its suppliers a harvest 2020 base price of €160/t for feed wheat and €142/t for feed barley on Friday, January 10.

The table below shows how prices were fairing on the LIFFE, MATIF, CBOT and Free-On-Board (FOB) Creil markets.