Moves in grain price over the Christmas period were positive, although the same moves weren’t huge.

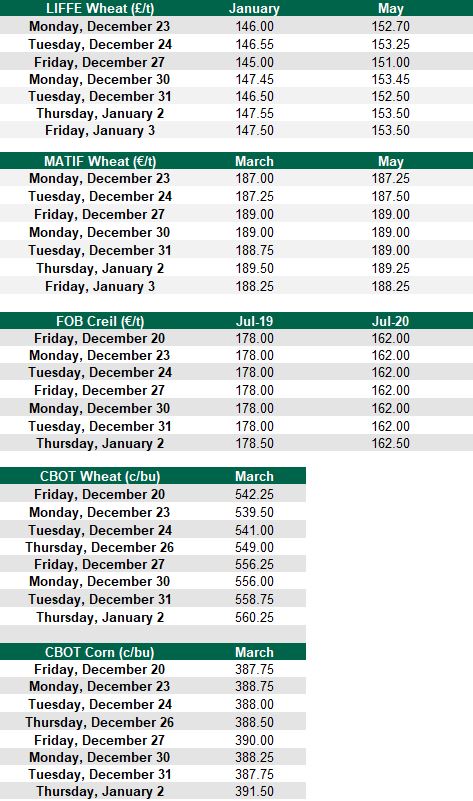

LIFFE wheat for January increased by €1.55/t from December 23 to January 1. MATIF wheat for March increased by €2.50/t in the same period.

Figures from the Agriculture and Horticulture Development Board (AHDB) show that there is estimated to be 2.98 million tonnes of wheat available for export or free stock in the UK for the 2019/2020 season. In 2018/2019, there were just 720,000t available.

UK wheat production increased by 19.7% from 2018 to 2019. 2019 was also the fifth-highest year for wheat production in the UK since 1999.

This has in turn impacted on grain prices. In December 2018, the average price paid for wheat was £173.15/t. In December 2019 that price dropped to £143.12/t.

EU balance sheet

EU wheat and barley production estimates were raised in December. The figures increased EU soft wheat production by 400,000t to 147.2 million tonnes from November.

Barley also increased by 400,000t and is now estimated at 63 million tonnes. That’s the largest crop since 2008.

The larger crop means that exports will have to move to avoid excessive carry over into the next season. Reports from the AHDB suggest that this “will require continental old crop prices to remain competitive, which could prevent new crop markets from gaining significantly”.

On week 24, wheat exports from the EU were at 12.8 million tonnes. The export forecast is 28 million tonnes. More than 50% of these exports have to move between weeks 24 and 53.

WASDE due this week

December’s World Agricultural Supply and Demand Estimates (WASDE) report didn’t do much for markets. January’s figures will be released next Friday, January 10.

Grain markets

The table below shows how price fared over the Christmas period from December 23 to January 3. EU markets closed on December 25 and 26, while US markets were open on December 26. All markets were closed on January 1.